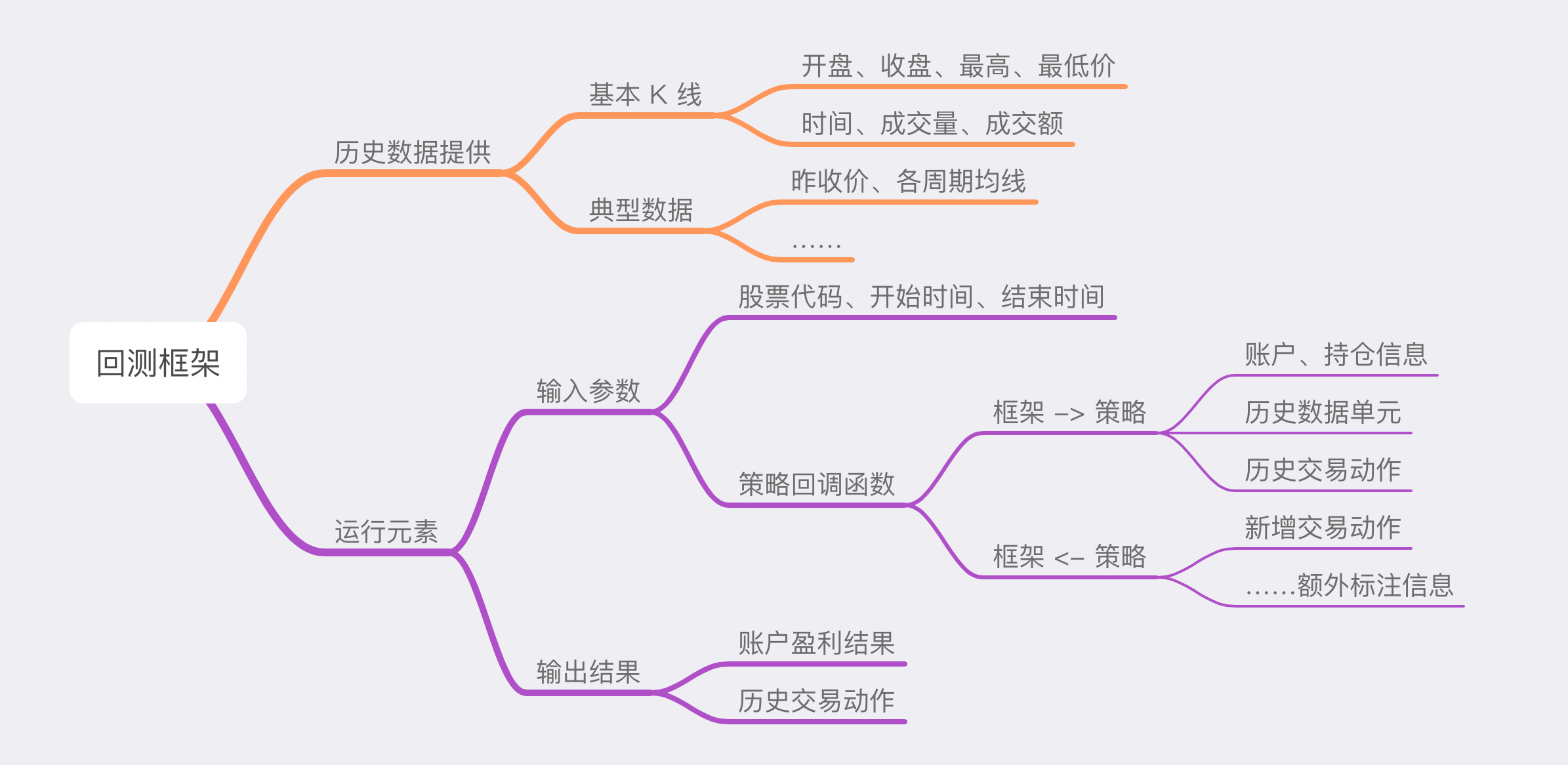

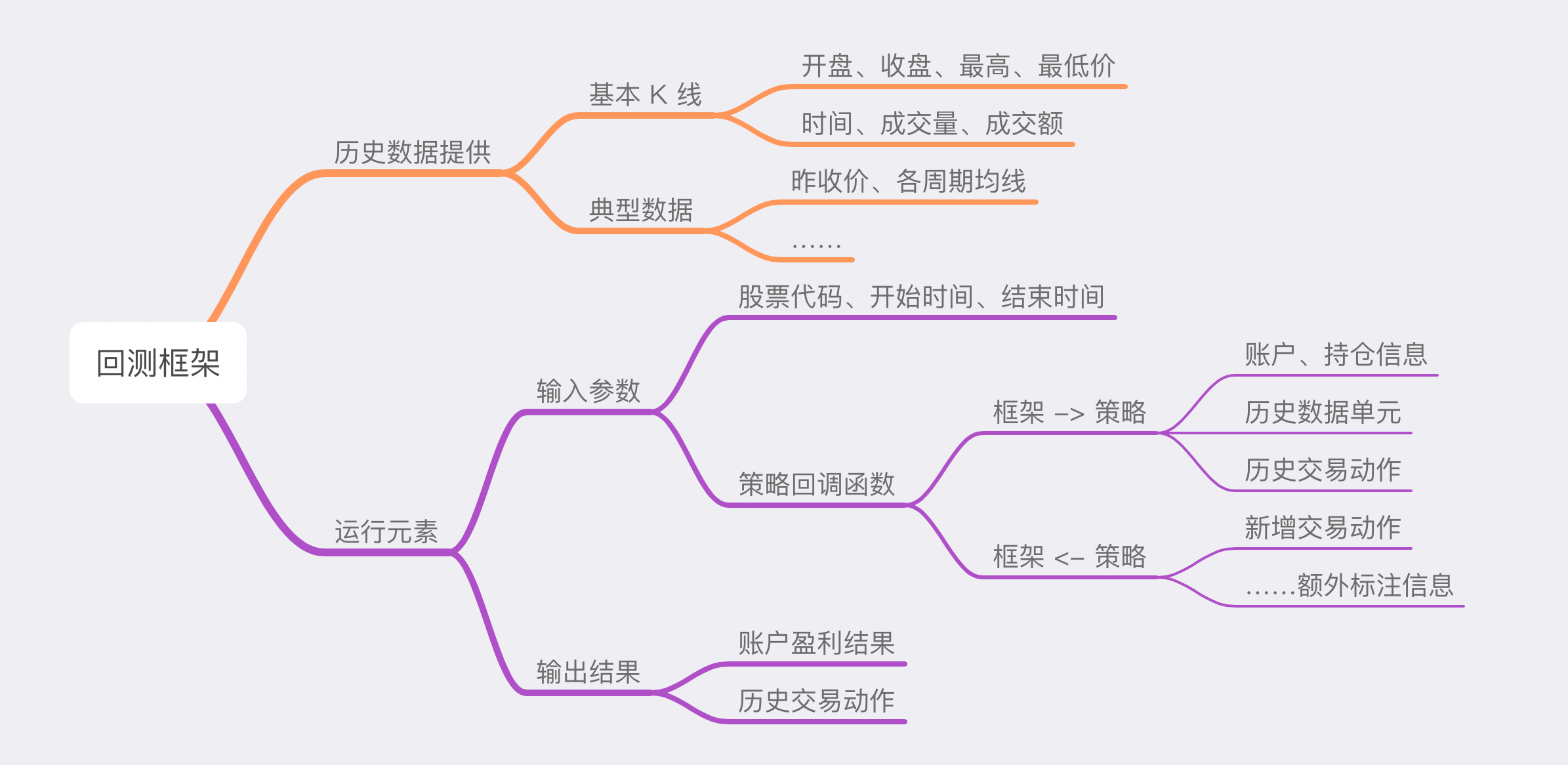

最近有许多典型的非典型的策略,想要回测历史表现。市面上的回测服务存在繁琐、限制较多的问题,不能满足需要。粗略想了下回测框架的实现并不复杂,用熟悉的编程语言,自己动手也许是成本最低的方式。

核心元素

以单一股票的策略为例,输入「股票代码、回测时间段、策略逻辑」,输出「盈利结果、历史交易动作」即可。多只股票组合亦同理。

代码实现

最简版

包含注释在内的最简版的核心代码不到 50 行

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

| export class BackTesting {

public readonly options: Options

constructor(options: Options) {

this.options = options

}

public async execute(period: KLinePeriod, klineCallback: KLineCallback) {

const accountInfo: AccountInfo = { balance: 0, position: 0, tradingItems: [], profit: 0 }

const kLines = await this.getKLines(period)

for (const curKLine of kLines) {

this.tradeForAccount(accountInfo, klineCallback({ kline: curKLine, account: accountInfo }))

}

accountInfo.profit = accountInfo.balance + accountInfo.position * kLines[kLines.length - 1].close

return accountInfo

}

public tradeForAccount(accountInfo: AccountInfo, tradingItems: TradingItem[]) {

tradingItems.forEach((tradingItem) => {

switch (tradingItem.action) {

case 'BUY':

accountInfo.position += tradingItem.quantity

accountInfo.balance -= tradingItem.quantity * tradingItem.price

break

case 'SELL':

accountInfo.position -= tradingItem.quantity

accountInfo.balance += tradingItem.quantity * tradingItem.price

break

}

})

accountInfo.tradingItems.push(...tradingItems)

}

public async getKLines(period: KLinePeriod): Promise<Classical_KLine[]> {

const kLines = await KLineTools.getStockKLines(this.options.stockCode, {

period: period,

beginTime: this.options.startTime,

endTime: this.options.endTime,

})

return kLines

}

}

|

均线策略框架

均线相关的交易策略非常常见。于是可以在核心函数基础上实现一个新的均线策略测试函数,使回调函数携带均线信息供策略开发者直接使用。

为了让每条回调数据都尽可能拥有均值信息,如 MA20 需要额外向前获取 20 条数据,于是可将 getKLines 方法微调,使其支持自定义的开始时间

1

2

3

4

5

6

7

8

| public async getKLines(period: KLinePeriod, startTime?: string): Promise<Classical_KLine[]> {

const kLines = await KLineTools.getStockKLines(this.options.stockCode, {

period: period,

beginTime: startTime || this.options.startTime,

endTime: this.options.endTime,

})

return kLines

}

|

testMA 支持 OptionsMA 传递,如 20 日均线为 { period: KLinePeriod.DAY, length: 20 }- 回调方法额外携带

prevMA、curMA 信息,供策略判断现价与均价的关系,以及均线朝向

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

| public async testMA(optionsMA: OptionsMA, klineCallback: MACallback) {

const accountInfo: AccountInfo = { balance: 0, position: 0, tradingItems: [], profit: 0 }

const { startTime } = this.options

const realStartTime = ((): string => {

if (optionsMA.period.endsWith('minute') || optionsMA.period.endsWith('hour')) {

return startTime

}

const period = optionsMA.period.split('/')![1] as any

return moment(startTime)

.subtract(optionsMA.length * 2, period)

.startOf(period)

.format('YYYY-MM-DD')

})()

const kLines = await this.getKLines(optionsMA.period, realStartTime)

const startIndex = ((): number => {

const keyTs = moment(startTime).unix()

return Math.max(

kLines.findIndex((item) => moment(item.time).unix() >= keyTs),

optionsMA.length

)

})()

if (startIndex < optionsMA.length) {

return accountInfo

}

let prevSum = kLines.slice(startIndex - optionsMA.length, startIndex).reduce((result, cur) => result + cur.close, 0)

for (let i = startIndex; i < kLines.length; ++i) {

const curKLine = kLines[i]

const curSum = prevSum - kLines[i - optionsMA.length].close + curKLine.close

const items = klineCallback({

kline: curKLine,

prevMA: prevSum / optionsMA.length,

curMA: curSum / optionsMA.length,

account: accountInfo,

})

this.tradeForAccount(accountInfo, items)

prevSum = curSum

}

accountInfo.profit = accountInfo.balance + accountInfo.position * kLines[kLines.length - 1].close

return accountInfo

}

|

回测示例

回测恒指期货 2022-01-01 ~ 2024-01-24 “收盘价站上 MA20 日线做多,跌破 MA20 日线平仓” 的示例代码

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

| const backTesting = new BackTesting({ stockCode: 'HSImain', startTime: '2022-01-01', endTime: '2024-01-24' })

const accountInfo = await backTesting.testMA(

{ period: KLinePeriod.DAY, length: 20 },

({ kline, curMA, account }) => {

const tradingItems: TradingItem[] = []

if (kline.close > curMA && account.position <= 0) {

tradingItems.push({ date: kline.time, action: 'BUY', price: kline.close, quantity: 1 })

} else if (kline.close < curMA && account.position > 0) {

tradingItems.push({ date: kline.time, action: 'SELL', price: kline.close, quantity: account.position })

}

return tradingItems

}

)

console.info(accountInfo)

console.info(`Trade ${accountInfo.tradingItems.length} times`)

|

输出结果为:交易 52 次,亏损 2111 😀

1

2

3

4

5

6

7

8

9

10

11

12

13

| {

balance: -2111,

position: 0,

tradingItems: [

{ date: '2022-01-07', action: 'BUY', price: 23467, quantity: 1 },

{ date: '2022-01-27', action: 'SELL', price: 23837, quantity: 1 },

……

{ date: '2023-12-27', action: 'BUY', price: 16657, quantity: 1 },

{ date: '2024-01-05', action: 'SELL', price: 16589, quantity: 1 }

],

profit: -2111

}

Trade 52 times

|

后续利用

- 有了易编程可复用的框架后,可将经典及突发奇想的策略落实为可执行代码,输入全市场全周期数据逐一验证

- 输出结果包含交易明细,可用于绘制策略资产净值曲线,计算最大回撤

- 对典型结果及非典型结果,可进行相关性归纳

附录(数据结构定义)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

| export interface Classical_KLine {

time: string

open: number

close: number

low: number

high: number

prev_close: number

close_p: number

volume: number

turnover: number

}

export enum KLinePeriod {

MIN_1 = '1/minute',

MIN_5 = '5/minute',

MIN_15 = '15/minute',

MIN_30 = '30/minute',

MIN_60 = '60/minute',

HOUR_1 = '1/hour',

HOUR_4 = '4/hour',

DAY = '1/day',

WEEK = '1/week',

MONTH = '1/month',

QUARTER = '1/quarter',

YEAR = '1/year',

}

export interface TradingItem {

date: string

action: 'BUY' | 'SELL'

price: number

quantity: number

}

export interface AccountInfo {

balance: number

position: number

tradingItems: TradingItem[]

profit: number

}

interface CallbackCoreData {

kline: Classical_KLine

account: AccountInfo

}

export interface MACallbackData extends CallbackCoreData {

kline: Classical_KLine

account: AccountInfo

prevMA: number

curMA: number

}

export type KLineCallback<T extends CallbackCoreData = CallbackCoreData> = (data: T) => TradingItem[]

export type MACallback = (data: MACallbackData) => TradingItem[]

|